Caesars Unloading LINQ Promenade for $275 Million

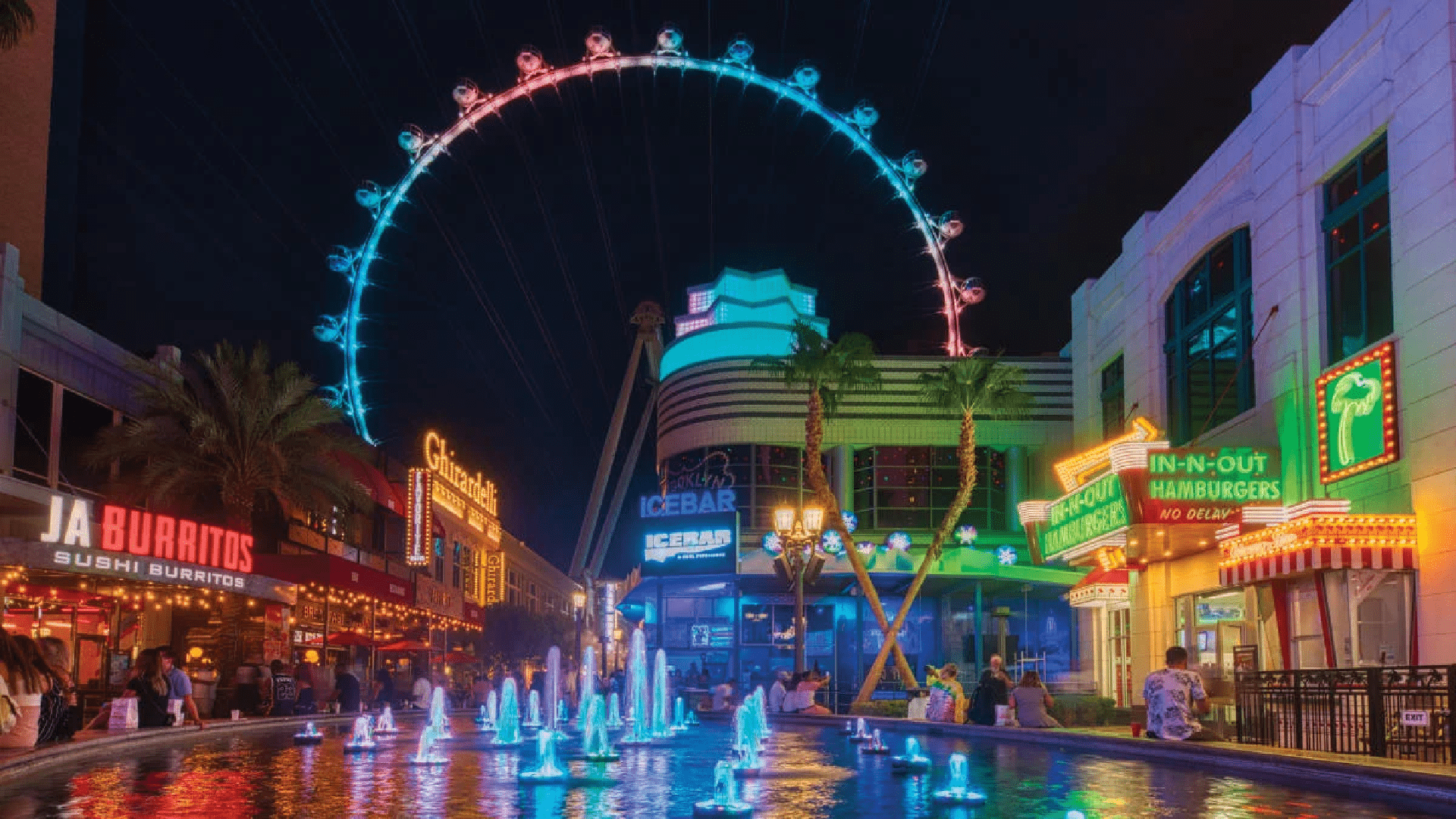

Caesars Entertainment (NASDAQ: CZR) declared that it is divesting the LINQ Promenade on the Las Vegas Strip for $275 million as part of the gaming firm's continuous efforts to reduce its debt.

A combined partnership consisting of TPG Real Estate and the Acadia Realty Trust investment management platform is purchasing the assortment of retail shops and boutiques situated close to the Caesars-operated LINQ Hotel. The casino resort is excluded from the deal, which is scheduled to finalize in the present quarter.

"The sale of the LINQ Promenade represents an accretive, non-core asset sale that will accelerate our debt reduction goals. I want to thank all the team members and the tenants of the LINQ Promenade for their partnership over the last 10 years and wish them continued success,” said Caesars CEO Tom Reeg in a statement.

Occupants of LINQ Promenade consist of O’Sheas Pub Las Vegas, I Love Sugar, Virgil’s Real BBQ, and the Tilted Kilt Pub, among various others.

Caesars LINQ Discount Not Unexpected

Last month, Casino.org was the initial source to showcase an analyst report suggesting Caesars might choose to sell LINQ Promenade as part of its larger capital-raising strategy, making today's announcement unsurprising, especially given the promenade's classification as a non-gaming asset.

The deal also aligns with statements made earlier this year by Reeg, who mentioned that the gaming firm would consider the sale of “non-core” assets. During that period, the CEO did not provide details on how those transactions might occur, but in the months that followed, Caesars has fulfilled that promise.

In August, Caesars revealed the sale of the intellectual property rights tied to the World Series of Poker (WSOP) to investment company NSUS Group Inc. for $500 million. The seller has announced today that the transaction is now complete, having received the initial payment of $250 million from the buyer. The balance is payable in five years.

“Caesars retains the right from NSUS to host the flagship WSOP live tournament series at its Las Vegas casinos for the next 20 years and will receive a license from NSUS to continue operating its recently upgraded WSOP Online real-money poker business in Nevada, New Jersey, Michigan, and Pennsylvania for the foreseeable future but will otherwise be restricted from operating online peer-to-peer real-money poker operations for a specified period of time and subject to certain excepti

LINQ Sale is Important for Debt-Reduction Strategy

The arrival of $250 million from the WSOP sale and an additional $275 million through the LINQ Promenade agreement expected before year-end indicates that Caesars is generating over $500 million from these two transactions.

This is significant because although the casino giant has been careful in reducing its debt, its overall outstanding liabilities reached $12.69 billion by the close of the third quarter, an increase from $12.43 billion at the end of the previous year.

This is probably due to the operator's cycle of capital expenditure, which is currently concluding. At the end of September, Caesars held $802 million in liquid assets and $124 million in restricted funds.

ons,” said Caesars in a separate statement.